In recent years, there has been a major shift in the financial industry with the emergence of blockchain technology and cryptocurrency. These innovative technologies have disrupted traditional financial systems and are paving the way for a more decentralized and secure future. With the rise of Bitcoin in 2009, the world was introduced to the concept of a digital currency that operates independently from central authorities. This opened up a whole new realm of possibilities for finance and economy, sparking a global interest in exploring the potential of blockchain and cryptocurrency.

Blockchain and cryptocurrency are often used interchangeably, but they are two distinct concepts. Blockchain is the underlying technology behind cryptocurrency, and it has a much broader scope of use beyond just digital currencies. In this article, we will delve into the world of blockchain and cryptocurrency, explore their potential in the finance sector, and discuss the current trends, benefits, challenges, and future implications of these technologies.

Introduction

The financial industry has always been heavily reliant on centralized governing bodies such as banks, governments, and other financial institutions. However, this centralized system has its limitations, including high transaction fees, lengthy processes, and security vulnerabilities. Blockchain technology offers an alternative by providing a decentralized and trustless network where financial transactions can be carried out without the need for intermediaries.

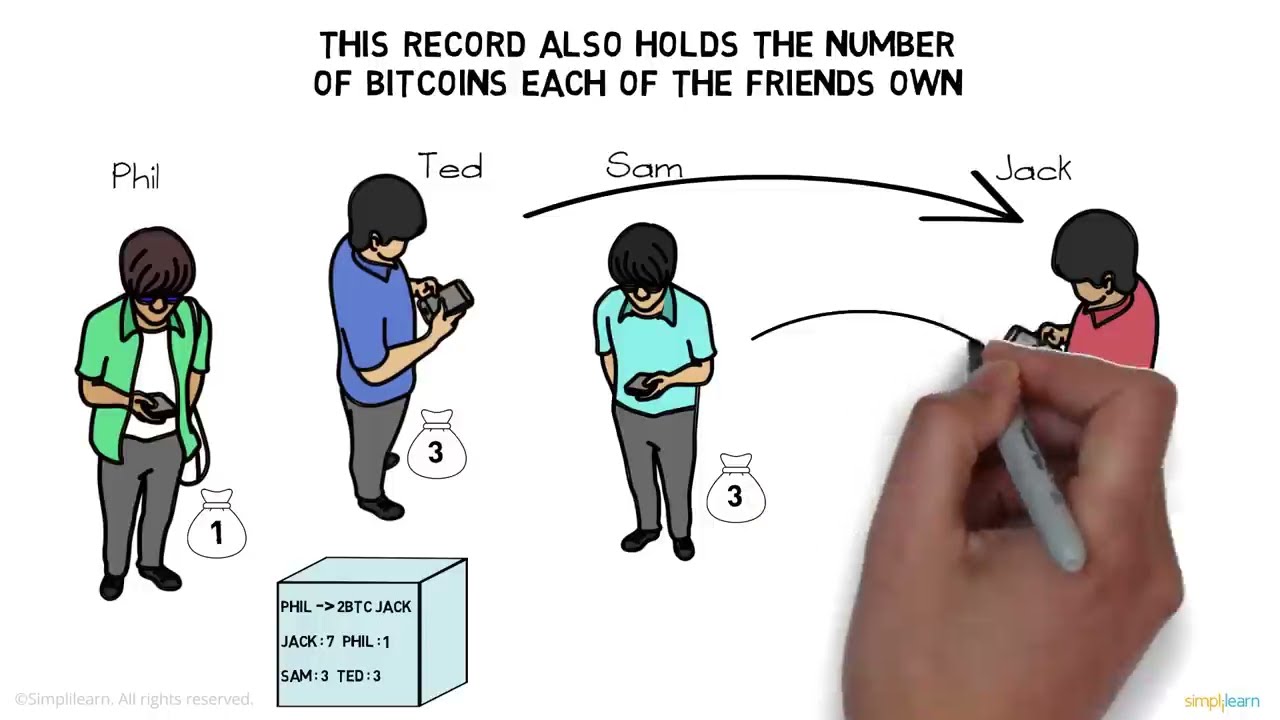

Blockchain is essentially a digital ledger of transactions that is distributed across a network of computers, making it almost impossible to alter or manipulate. Each block in the chain contains a record of multiple transactions, and once a block is added to the chain, it becomes permanent and cannot be modified. This makes blockchain inherently secure and transparent, as all transactions are recorded and verified by multiple nodes on the network.

Cryptocurrency, on the other hand, is a digital or virtual currency that operates using blockchain technology. It is decentralized and operates independently from central authorities, making it immune to government interference and manipulation. The most well-known cryptocurrency is Bitcoin, but there are now thousands of other cryptocurrencies in circulation, each with its own unique features and uses.

Overview of Blockchain Technology

Blockchain technology was first introduced in 2008 by an unknown person or group of people under the pseudonym Satoshi Nakamoto. It was initially created to serve as the public transaction ledger for the digital currency Bitcoin. However, it has since evolved to have a much wider scope of use beyond just digital currencies.

The concept behind blockchain is simple yet revolutionary. A blockchain is a decentralized network of nodes, where each node has a copy of the entire chain of blocks. When a new transaction occurs, it is broadcasted across the network, and these nodes use complex algorithms to verify and add the transaction to a block. Once the block is verified and added, it becomes part of the permanent chain, and the transaction cannot be altered.

One of the key features of blockchain technology is its decentralization. Unlike traditional financial systems, where transactions are processed and approved by central authorities, blockchain operates on a peer-to-peer network, where each node acts as both a user and a validator. This eliminates the need for intermediaries, reduces transaction fees, and increases efficiency and transparency.

Another important aspect of blockchain is its immutability. Once a block is added to the chain, it cannot be modified or deleted. This makes blockchain inherently secure, as it eliminates the possibility of data tampering or fraud. Additionally, since all transactions are recorded on multiple nodes, it becomes almost impossible for hackers to compromise the system.

Overview of Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses blockchain technology to operate independently from central authorities. The first and most well-known cryptocurrency is Bitcoin, which was created in 2009. However, there are now thousands of other cryptocurrencies in circulation, each with its own unique features and uses.

Cryptocurrencies work on the basis of a peer-to-peer network, where users can send and receive funds directly without the need for intermediaries. Each transaction is recorded on the blockchain and verified by multiple nodes on the network. Cryptocurrencies also use complex cryptography to secure transactions, making them almost impossible to counterfeit or duplicate.

One of the main advantages of cryptocurrency is its decentralization. As there is no central authority controlling the currency, it remains immune to government interference and manipulation. This makes it a popular choice for individuals and businesses looking for a more secure and private alternative to traditional currencies.

Cryptocurrencies also offer faster and cheaper transaction processing compared to traditional financial systems. As there are no intermediaries involved, there are no transaction fees, and transactions can be carried out in a matter of minutes rather than days. This makes it an attractive option for international payments, where traditional methods can be costly and time-consuming.

Current Trends in Finance

The adoption of blockchain and cryptocurrency in the finance sector has been steadily increasing over the past few years. In 2020, the total market capitalization of cryptocurrencies reached an all-time high of $1 trillion. This growth can be attributed to several factors, including increased awareness and interest from institutional investors and the growing acceptance of digital currencies by governments around the world.

One of the major trends in finance currently is the integration of cryptocurrency into traditional financial systems. This allows for a seamless transition between digital and fiat currencies, making it easier for individuals and businesses to adopt and use cryptocurrency. For example, companies like PayPal and Square have integrated cryptocurrency features into their platforms, allowing users to buy, sell, and hold cryptocurrencies.

Another trend is the rise of Central Bank Digital Currencies (CBDCs). These are digital versions of traditional currencies issued by central banks. CBDCs operate on a blockchain network, providing the benefits of digital currencies while still being backed by a central authority. Several countries, including China, Sweden, and the Bahamas, are already in the process of launching their own CBDCs.

Another significant development is the growing interest and investment from institutional investors. Major financial institutions such as Goldman Sachs, JPMorgan, and Morgan Stanley have started offering cryptocurrency services to their clients. This has given legitimacy to the industry and has paved the way for more widespread adoption by individuals and businesses.

Benefits of Blockchain and Cryptocurrency in Finance

The integration of blockchain and cryptocurrency in finance offers numerous benefits, both for individuals and businesses. Some of the key advantages include:

Increased Efficiency

One of the main benefits of blockchain and cryptocurrency is increased efficiency. As there are no intermediaries involved, transactions can be carried out directly between parties, reducing processing time and costs. Additionally, since all transactions are recorded on the blockchain, it eliminates the need for manual record-keeping and reduces the chances of human error.

Lower Transaction Fees

Traditional financial systems involve multiple intermediaries, which can lead to high transaction fees. With blockchain and cryptocurrency, these intermediaries are eliminated, resulting in significantly lower transaction fees. This makes it an attractive option for individuals and businesses looking to save on transaction costs.

Enhanced Security

Blockchain technology provides enhanced security for financial transactions. As each block is cryptographically linked to the previous one, it becomes almost impossible for hackers to compromise the system without being detected. Additionally, the decentralized nature of blockchain means that there is no single point of failure, making it more resilient to cyber attacks.

Improved Transparency

Blockchain technology offers a high level of transparency, as all transactions are recorded and verified on a distributed ledger. This means that anyone can view the records, ensuring accountability and trust within the system. This eliminates the need for third-party audits and increases transparency in financial transactions.

Financial Inclusion

Blockchain and cryptocurrency also have the potential to increase financial inclusion, especially for individuals in underbanked or unbanked regions. With traditional financial systems, individuals may face barriers to access due to high fees or lack of documentation. With blockchain and cryptocurrency, individuals can access financial services directly from their mobile devices, without the need for a traditional bank account.

Challenges and Risks

While blockchain and cryptocurrency offer numerous advantages, there are also some challenges and risks that need to be addressed. These include:

Scalability

One of the main challenges facing blockchain technology is scalability. As more transactions are added to the blockchain, it becomes increasingly difficult to process them in a timely manner. This can lead to slow transaction times and high fees. Efforts are being made to address this issue through the development of new protocols and technologies, but it remains a significant challenge for widespread adoption.

Regulatory Uncertainty

The decentralized and unregulated nature of blockchain and cryptocurrency has led to uncertainty in terms of regulation. Governments around the world are still grappling with how to regulate these technologies, which has led to varying levels of acceptance and legality in different countries. This poses a risk for businesses and investors, as regulations can change at any time, potentially affecting the value and use of cryptocurrencies.

Volatility

Cryptocurrencies are known for their volatility, with values often fluctuating significantly in short periods. This makes it a risky investment option, as the value of your holdings can decrease rapidly. However, as the industry matures and more institutional investors get involved, it is expected that the volatility will decrease.

Case Studies

There have been numerous successful case studies showcasing the potential of blockchain and cryptocurrency in the finance sector. Some notable examples include:

Ripple (XRP)

Ripple is a payment network that uses blockchain technology to facilitate cross-border transactions. It offers faster and cheaper money transfers compared to traditional methods, making it an attractive option for financial institutions. Ripple’s clients include major banks such as Santander, Standard Chartered, and American Express.

Binance

Binance is one of the largest cryptocurrency exchanges in the world, with over 100 million registered users. It offers a wide range of trading services and operates on its own blockchain network, Binance Chain. Binance has also launched its own cryptocurrency, Binance Coin (BNB), which is used to pay for fees on the platform.

MakerDAO

MakerDAO is a decentralized lending platform that allows users to borrow against their cryptocurrency holdings without having to sell them. This eliminates the need for intermediaries such as banks and provides individuals with access to credit without the barriers of traditional financial systems.

Future Implications

The potential of blockchain and cryptocurrency in finance is vast, and it is expected to have a significant impact on the industry in the coming years. Some of the future implications include:

Increased Adoption

As more institutions and businesses start accepting and using cryptocurrencies, we can expect to see an increase in adoption among individuals. This will lead to a wider acceptance of digital currencies as a legitimate form of payment, potentially reducing our reliance on traditional currencies.

Disruption of Traditional Financial Systems

Blockchain and cryptocurrency have the potential to disrupt traditional financial systems by providing an alternative that is faster, cheaper, and more secure. This could potentially lead to a decrease in the role of central authorities and a shift towards decentralized networks.

New Business Models

The rise of blockchain and cryptocurrency has given way to new business models that were not previously possible. For example, the emergence of decentralized finance (DeFi) platforms allows individuals to access financial services without the need for intermediaries. We can expect to see more innovative business models being developed as these technologies continue to evolve.

Conclusion

In conclusion, the emergence of blockchain technology and cryptocurrency has opened up a whole new realm of possibilities for the finance sector. These innovative technologies offer numerous benefits, including increased efficiency, lower transaction fees, enhanced security, transparency, and financial inclusion. However, there are also challenges and risks that need to be addressed, such as scalability and regulatory uncertainty.

Despite these challenges, the future looks bright for blockchain and cryptocurrency in finance. With the growing acceptance and adoption of digital currencies by governments and financial institutions, we can expect to see a significant impact on traditional financial systems in the coming years. As technology continues to evolve, it is essential to keep exploring and embracing its potential for a more decentralized and secure future of finance.