The world of finance is undergoing a paradigm shift. Gone are the days of centralized institutions holding the reins of our financial lives. A new era is dawning, one fueled by blockchain technology and cryptocurrencies, promising greater transparency, security, and control over our assets.

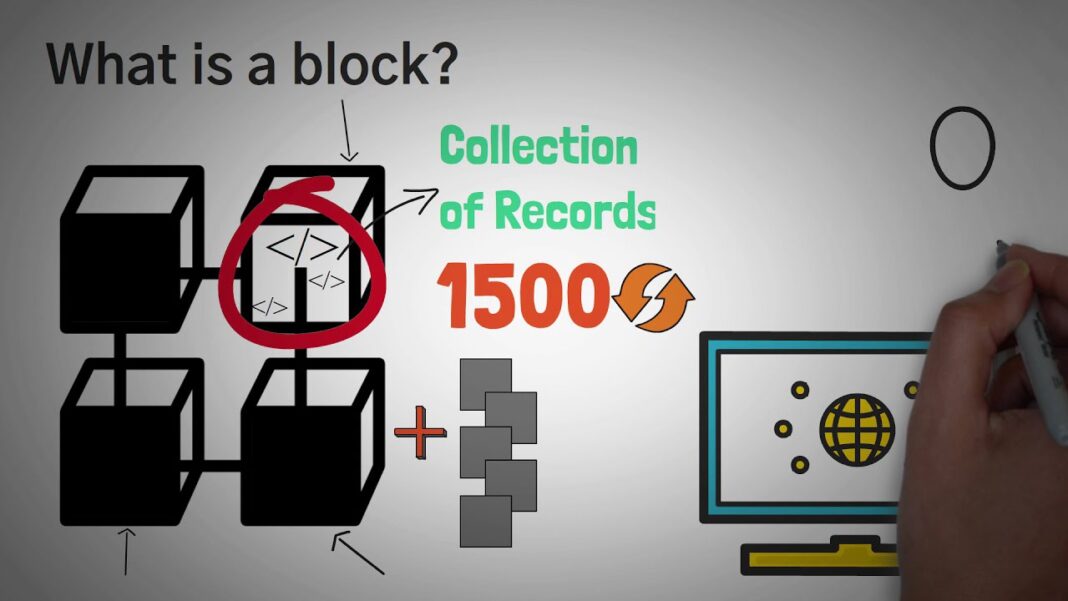

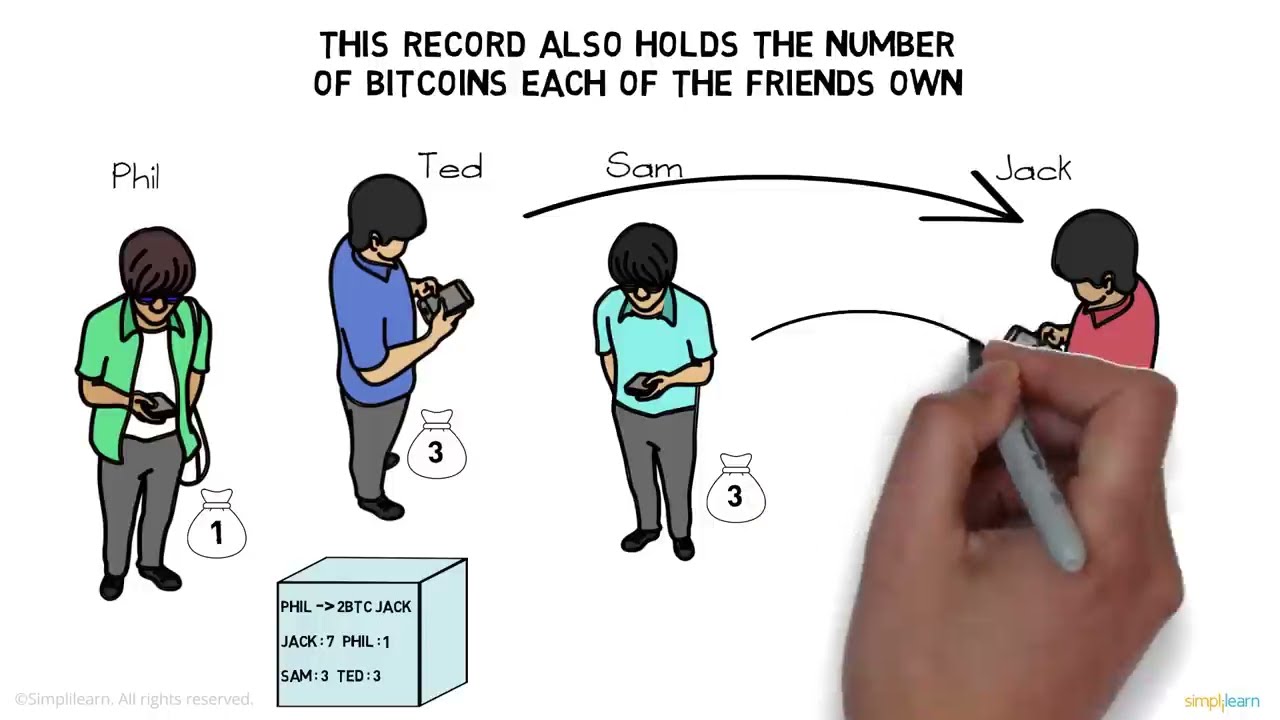

But what exactly is blockchain? In simple terms, it is a digital ledger, a chain of blocks, each containing a record of transactions. These blocks are linked together chronologically, forming an immutable and transparent record of all activity. What truly differentiates blockchain from traditional databases is its decentralized nature. Instead of central authority managing the ledger, blockchain relies on a distributed network of computers called nodes. Each node holds a copy of the blockchain and participates in verifying and adding new transactions to the chain. This distributed consensus mechanism ensures that the blockchain is highly secure and resistant to tampering.

Overview of Cryptocurrency

Cryptocurrencies are digital or virtual currencies that use blockchain technology for secure and decentralized transactions. The first and most well-known cryptocurrency is Bitcoin, launched in 2009. Since then, thousands of other cryptocurrencies have emerged, such as Ethereum, Ripple, and Litecoin.

Unlike fiat currencies, which are issued and controlled by central authorities, cryptocurrencies are decentralized and operate independently of any government or financial institution. Transactions are recorded on the blockchain and verified by the nodes, making them secure and transparent. Additionally, cryptocurrencies offer fast and low-cost transactions, as they eliminate the need for intermediaries like banks. This makes them attractive for peer-to-peer transactions, cross-border payments, and micropayments.

Current State of Finance Industry

The finance industry has traditionally been dominated by centralized institutions, such as banks, stock exchanges, and insurance companies. These institutions act as intermediaries, facilitating transactions and earning profits through fees and interest rates. However, this model has led to issues such as lack of transparency, high transaction costs, and security concerns.

With the rise of blockchain technology and cryptocurrencies, the finance industry is experiencing a disruption. According to a report by PwC, investments in blockchain technology in the finance sector have increased from $1.4 billion in 2016 to $4.4 billion in 2019. This indicates a growing interest in the potential of blockchain to transform the industry.

Potential Impact of Blockchain Technology on Finance

The potential impact of blockchain technology on the finance industry is far-reaching. Here are some key areas where it is already making an impact:

Decentralized Finance (DeFi)

One of the most significant impacts of blockchain on finance is the rise of decentralized finance (DeFi). DeFi refers to the use of blockchain technology to create decentralized financial systems such as lending, borrowing, and trading platforms without the need for intermediaries.

DeFi has the potential to disrupt traditional banking systems by offering more accessible, faster, and cheaper financial services. These services are available to anyone with an internet connection, regardless of their location or socioeconomic status. Additionally, DeFi can also provide financial inclusion for the unbanked population, who do not have access to traditional banking systems.

Smart Contracts

Smart contracts are self-executing digital contracts that are coded and stored on the blockchain. They automatically execute when certain conditions are met, eliminating the need for intermediaries and reducing costs.

These smart contracts can be used in various financial transactions, such as insurance claims processing and supply chain management. They can also be programmed to release funds only when specific conditions are met, increasing trust and security in transactions.

Tokenization of Assets

Blockchain technology also enables the tokenization of real-world assets, such as property, art, and even stocks. This involves converting these assets into digital tokens and recording them on the blockchain, allowing for easier transfer and fractional ownership.

Tokenization has the potential to increase liquidity and accessibility to previously illiquid assets, such as real estate. It also reduces transaction and ownership costs, making it easier for individuals to invest in a diverse range of assets.

Case Studies of Companies Using Blockchain in Finance

Numerous companies across various industries are already utilizing blockchain technology to revolutionize the finance industry. Here are some notable examples:

JPMorgan Chase & Co.

JPMorgan Chase & Co., one of the largest banks in the world, has been actively exploring the use of blockchain technology in its operations. In 2019, they launched JPM Coin, a stablecoin that enables the real-time settlement of institutional payments using blockchain. This has reduced the time and costs associated with traditional wire transfers.

Ripple

Ripple, a San Francisco-based fintech company, uses blockchain technology to facilitate cross-border payments for financial institutions. Its payment protocol, XRP Ledger, allows for fast and low-cost transactions compared to traditional methods. Ripple has partnered with over 200 financial institutions globally, including Santander and American Express.

Maersk and IBM

In 2018, shipping giant Maersk and technology company IBM collaborated to launch TradeLens, a blockchain-based supply chain platform. The platform aims to digitize trade processes, reduce paperwork, and increase transparency in the global supply chain. Several companies, including major ports and customs authorities, have joined the platform, making it one of the most significant blockchain initiatives in the logistics industry.

Challenges and Opportunities of Integrating Blockchain in Finance

While blockchain technology has the potential to disrupt the finance industry positively, there are still some challenges that need to be addressed:

Regulatory Uncertainty

The lack of standardized regulations for cryptocurrencies and blockchain technology poses a significant challenge to its widespread adoption in the finance industry. Governments and regulatory bodies are still trying to understand this emerging technology and determine how to regulate it effectively.

Scalability Issues

Blockchain technology is still in its early stages, and as such, cannot handle large volumes of transactions efficiently. This has led to concerns about its scalability, especially when it comes to applications in the finance industry, which requires high transaction speeds.

On the other hand, integrating blockchain technology into existing financial systems also presents numerous opportunities:

Cost Savings

Blockchain technology eliminates the need for intermediaries, reducing transaction costs significantly. This makes it an attractive option for businesses looking to streamline their operations and reduce costs.

Increased Efficiency

By automating processes and reducing paperwork, blockchain technology can increase efficiency in financial systems. This will lead to faster transaction processing times, minimized errors, and improved customer experience.

Enhanced Security

The decentralized and immutable nature of blockchain technology makes it highly secure and resistant to tampering. This makes it an ideal solution for storing sensitive financial data and conducting secure transactions.

Future Trends in Finance Industry with Blockchain Technology

The future of finance is undoubtedly intertwined with blockchain technology. Here are some trends that we can expect to see in the coming years:

Central Bank Digital Currencies (CBDCs)

Several central banks worldwide, including China and the Bahamas, are exploring the possibility of issuing a central bank digital currency (CBDC). CBDCs are digital versions of fiat currencies, backed by the central bank and recorded on the blockchain. These have the potential to make payments faster, cheaper, and more efficient.

Stablecoins

Stablecoins are cryptocurrencies that aim to maintain a stable value by being pegged to a fiat currency or a basket of assets. These offer less volatility compared to other cryptocurrencies, making them more attractive to investors and merchants for everyday transactions.

Blockchain-based Identity Solutions

Identity theft and fraud are significant issues in the finance industry. Blockchain technology can provide a solution by creating a secure and decentralized identity system. Individuals can control their identities through private keys, and transactions can be verified quickly, reducing the risk of fraud.

Conclusion

Blockchain technology has the potential to transform the finance industry by offering greater transparency, security, and efficiency. While there are still challenges that need to be addressed for its widespread adoption, the opportunities it presents are immense. As more companies and industries embrace this technology, we can expect to see a significant shift in how financial services are offered and consumed. The future of finance is indeed exciting, and blockchain is at the forefront of this revolution.