The world stands on the precipice of a technological revolution, fueled by the decentralized and transparent power of blockchain technology. More than just a buzzword, blockchain is transforming the way we interact with money, data, and even our very understanding of trust. At its core, it promises a new paradigm where information is controlled not by central authorities, but by a distributed network of users, empowering individuals and shaking up institutions.

In this article, we will delve into the intricacies of blockchain and cryptocurrency, examining their potential to disrupt established systems and usher in a future where digital assets hold immense value and influence. We will explore the fundamentals of blockchain technology and cryptocurrency, the current trends in finance, the benefits and challenges of implementing blockchain in finance, and the role of cryptocurrency in shaping the future of finance. Finally, we will conclude with a look at the future possibilities of blockchain and cryptocurrency in the financial sector.

Overview of Blockchain Technology

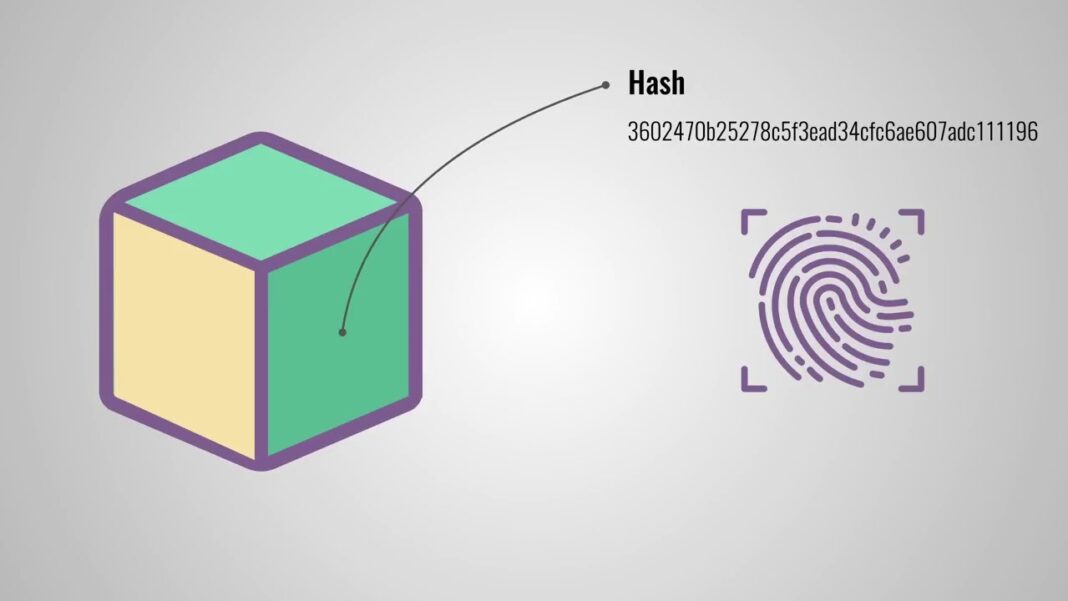

The term blockchain itself is descriptive, highlighting its fundamental structure: a chain of blocks. Each block contains a record of transactions, much like a ledger, and each block is linked to the one preceding it via a cryptographic hash – a unique identifier generated using complex algorithms. This intricate web of interconnected blocks forms a secure, immutable, and transparent ledger, publicly accessible for all to verify. The nature of blockchain ensures that once a transaction is added to the ledger, it cannot be altered or removed, creating an auditable trail of activity.

Decentralization and Transparency

One of the key features of blockchain technology is its decentralization. Unlike traditional systems where data is stored and controlled by a central authority, blockchain utilizes a distributed network of nodes to store and verify information. This eliminates the need for intermediaries and reduces the risk of single points of failure or manipulation. It also means that there is no central authority that can control or manipulate the data, making it highly transparent and resistant to corruption.

Security and Immutable Records

The use of cryptographic hash functions and distributed consensus algorithms make blockchain technology highly secure. This means that data stored on a blockchain cannot be easily tampered with, ensuring the integrity of records. Additionally, the decentralized nature of blockchain also makes it difficult for hackers to attack the system, as there is no central point of entry. This level of security is especially crucial in financial transactions, where trust and accuracy are paramount.

Smart Contracts

Another significant aspect of blockchain technology is its ability to facilitate the execution of smart contracts. These are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. Once these conditions are met, the contract is automatically executed, eliminating the need for intermediaries and streamlining processes. This has the potential to revolutionize various industries, including finance, by reducing costs, increasing efficiency, and minimizing the risk of fraud.

Overview of Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses blockchain technology to secure and verify transactions. It operates independently of any central authority, making it decentralized and immune to government intervention or manipulation. The first cryptocurrency, Bitcoin, was launched in 2009, and since then, thousands of other cryptocurrencies have emerged, each with its specific features and purposes.

Blockchain-based Currency

One of the main advantages of cryptocurrency is that it is based on blockchain technology, making it highly secure, transparent, and decentralized. Unlike fiat currencies, which are controlled and issued by governments, cryptocurrency is not subject to inflation or government interference. This makes it an attractive option for those seeking to transact without the involvement of third parties.

Anonymity and Privacy

Cryptocurrencies offer a high level of anonymity and privacy as they do not require users to provide personal information for transactions. Instead, transactions are recorded on the blockchain using unique digital signatures, ensuring that ownership of the cryptocurrency is traceable but not necessarily identifiable. This has made it a popular choice for those seeking to conduct financial transactions without revealing their identity.

Volatility and Speculation

One of the major criticisms of cryptocurrency is its highly volatile nature. The value of cryptocurrencies can fluctuate significantly in a short period, making them a risky investment option. This volatility is partly due to speculation, as the market is highly influenced by supply and demand. However, as more businesses and institutions begin to adopt and accept cryptocurrencies, this volatility may decrease.

Current Trends in Finance

The finance industry has been one of the most impacted by the rise of blockchain technology and cryptocurrency. Many traditional financial institutions have been exploring ways to leverage the benefits of blockchain and cryptocurrency to increase efficiency and reduce costs. Some of the current trends in finance include:

Cryptocurrency Adoption

While still in its early stages, there has been a significant increase in the adoption of cryptocurrency by traditional financial institutions. Investment banks, hedge funds, and other financial institutions are now offering cryptocurrency as an investment option for their clients. Furthermore, some companies have begun to accept cryptocurrency as a form of payment, showing the growing acceptance and trust in this alternative form of currency.

Digital Asset Management

With the rise of digitization, there has been an increasing need for more efficient and secure ways to manage assets. Blockchain technology provides a solution to this, with its ability to track and verify asset ownership and transfer. This has led to the emergence of digital asset management platforms that utilize blockchain technology to streamline processes and provide real-time tracking and reporting.

Cross-Border Transactions

Blockchain technology and cryptocurrency have also shown great potential in facilitating cross-border transactions. Traditional methods of conducting international transactions are often slow, expensive, and prone to errors. With blockchain technology, these transactions can be carried out quickly, securely, and at a fraction of the cost. This has the potential to revolutionize global commerce and trade.

Benefits of Blockchain in Finance

The implementation of blockchain technology in finance has the potential to bring about numerous benefits. Some of these include:

Cost Reduction

One of the most significant advantages of blockchain technology is its ability to reduce costs. By eliminating intermediaries, streamlining processes, and increasing efficiency, blockchain can significantly lower transactional fees and overhead costs. This has the potential to save financial institutions billions of dollars annually.

Increased Transparency

The decentralized and transparent nature of blockchain makes it an ideal solution for increasing transparency in finance. With all transactions recorded on the blockchain, there is a complete audit trail that can be accessed by anyone. This reduces the risk of fraud and increases trust between parties.

Faster Settlement Times

Traditional financial systems often involve multiple intermediaries, leading to slow settlement times. With blockchain technology, transactions are carried out directly between parties, eliminating the need for intermediaries and reducing settlement times from days to minutes.

Improved Security

The use of cryptographic hash functions and distributed consensus algorithms make blockchain technology highly secure. This reduces the risk of fraud and cyber attacks, making it an attractive option for financial transactions.

Challenges of Implementing Blockchain in Finance

While the potential benefits of implementing blockchain technology in finance are significant, there are also several challenges that need to be addressed. These include:

Technological Barriers

Implementing blockchain technology requires a certain level of technical expertise, making it challenging for traditional financial institutions to adopt. Furthermore, legacy systems may not be compatible with blockchain technology, requiring significant investment to upgrade or replace them.

Regulatory Uncertainty

The legal and regulatory framework surrounding blockchain technology and cryptocurrency is still developing, leading to uncertainty and hesitation among financial institutions. This is especially true in countries where there are no clear laws or regulations governing the use of cryptocurrencies.

Resistance to Change

The finance industry is known for its slow adoption of new technologies, and blockchain is no exception. There may be resistance to change from established institutions, as they may see it as a threat to their business models.

Role of Cryptocurrency in Finance

Cryptocurrency has the potential to play a significant role in shaping the future of finance. Some of its possible applications include:

Peer-to-Peer Transactions

Blockchain-based cryptocurrencies allow for direct peer-to-peer transactions without the need for intermediaries. This has the potential to disrupt traditional banking systems, where banks act as intermediaries and charge high fees for transactions.

Decentralized Finance

Decentralized finance, or DeFi, is an emerging trend that utilizes blockchain technology and smart contracts to create a more open, transparent, and accessible financial system. It allows for the creation of financial instruments and services without relying on traditional intermediaries such as banks.

Cross-Border Payments

As mentioned earlier, cryptocurrency has shown great potential in facilitating cross-border transactions, which have traditionally been slow and expensive. By eliminating intermediaries and reducing transactional fees, cryptocurrency can make international payments faster and cheaper.

Future Possibilities of Blockchain and Cryptocurrency in Finance

The potential of blockchain technology and cryptocurrency in finance goes far beyond what we have discussed so far. Some of the possibilities for the future include:

Central Bank Digital Currencies

Central banks around the world are exploring the possibility of issuing their own digital currencies. These central bank digital currencies (CBDCs) would utilize blockchain technology and could potentially replace traditional fiat currencies. This could revolutionize the global financial system, making transactions faster, cheaper, and more secure.

Tokenization of Assets

The tokenization of assets involves representing physical assets, such as real estate or artwork, as digital tokens on a blockchain. This would make it easier for these assets to be traded, divided, or transferred, increasing their liquidity and accessibility.

Inclusive Financial Services

Blockchain technology and cryptocurrency have the potential to provide financial services to those who do not have access to traditional banking systems. This includes the unbanked population in developing countries, who can now participate in global commerce and trade without relying on intermediaries.

Conclusion

In conclusion, blockchain technology and cryptocurrency are set to revolutionize the financial industry, offering numerous benefits such as increased transparency, efficiency, and security. While there are still challenges to overcome, the potential for disruption and innovation is immense. As more businesses and institutions begin to adopt and explore the possibilities of blockchain and cryptocurrency, we can expect to see a future where digital assets hold immense value and influence. The age of decentralized finance is upon us, and it is an exciting time to be a part of this technological revolution.